Mortgage Broker Glendale CA: Helping You Navigate the Home Loan Process

Mortgage Broker Glendale CA: Helping You Navigate the Home Loan Process

Blog Article

The Advantages of Engaging a Mortgage Broker for First-Time Homebuyers Looking For Tailored Financing Solutions and Professional Guidance

For first-time buyers, browsing the intricacies of the mortgage landscape can be challenging, which is where involving a home loan broker proves invaluable. Brokers supply individualized funding solutions customized to individual economic circumstances, while additionally supplying professional guidance throughout the whole process.

Recognizing Home Mortgage Brokers

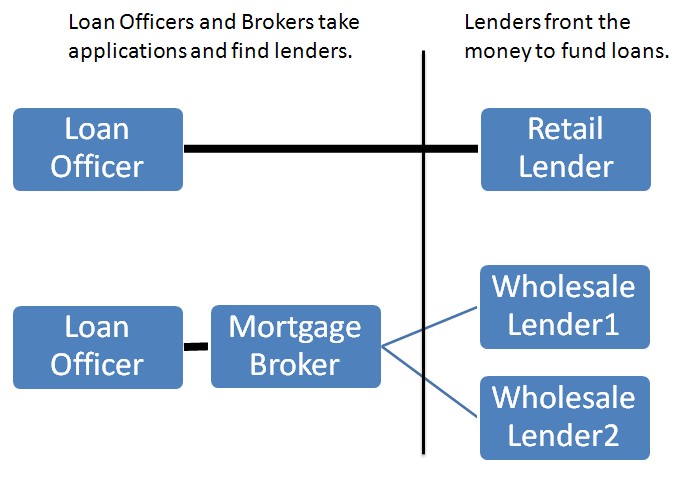

A mortgage broker works as an intermediary between lenders and debtors, facilitating the financing application process for property buyers. They possess expertise in the home loan market and are fluent in various lending items available. This understanding permits them to guide newbie homebuyers with the often complex landscape of home mortgage options.

Normally, home mortgage brokers work with a range of lending institutions, enabling them to present several funding options tailored to the details demands of their clients. Their function includes analyzing a borrower's financial circumstance, creditworthiness, and homeownership goals to match them with appropriate lending institutions. This not just saves time however likewise boosts the chance of securing positive lending terms.

Furthermore, home loan brokers manage the documentation and communicate with loan providers in support of the debtor, enhancing the process and reducing a few of the tension connected with acquiring a home loan. They likewise remain upgraded on market patterns and governing changes, ensuring that clients obtain prompt and precise recommendations. By leveraging their connections with lenders, mortgage brokers can often bargain far better prices and terms than individuals could safeguard by themselves, making their services indispensable for novice property buyers navigating the mortgage procedure.

Personalized Funding Solutions

Customized funding options are crucial for new homebuyers seeking to browse the intricacies of the mortgage landscape. Each property buyer's financial situation is one-of-a-kind, incorporating varying credit score scores, revenue levels, and individual monetary goals. Involving a mortgage broker enables buyers to accessibility tailored financing choices that straighten with their certain needs, making sure a more effective home mortgage experience.

Mortgage brokers have accessibility to a wide variety of loan providers and mortgage products, which allows them to present customized choices that might not be available with typical banks. They can analyze a customer's financial profile and recommend ideal finance programs, such as traditional financings, FHA fundings, or VA financings, depending on the person's qualifications and goals.

Moreover, brokers can negotiate terms with loan providers on part of the buyer, potentially safeguarding far better rate of interest rates and reduced costs. This tailored method not just improves the chances of financing approval however likewise gives peace of mind, as first-time customers typically really feel overwhelmed by the decision-making process.

Inevitably, customized financing services used by home loan brokers empower new property buyers to make enlightened selections, leading the way towards effective homeownership tailored to their monetary scenarios. Mortgage Broker Glendale CA.

Professional Support Throughout the Process

Specialist advice throughout the home mortgage procedure is very useful for new buyers, that might discover the complexities of safeguarding a lending intimidating. A mortgage broker acts as an essential resource, offering knowledge that assists navigate the myriad of alternatives and demands entailed. From the preliminary assessment to closing, brokers provide clarity on each action, making sure that property buyers understand their selections and ramifications.

Mortgage brokers streamline the application process by helping with documents and paperwork, which can usually be frustrating for novices. They help recognize prospective pitfalls, informing clients on usual errors to stay clear of, and making sure that all necessary info is properly presented to lenders. This proactive technique not just improves the procedure but likewise enhances the chance of protecting desirable funding terms.

Accessibility to Several Lenders

Access to multiple lending institutions is a substantial advantage for first-time buyers collaborating with a home loan broker. Unlike traditional banks, which may provide a limited variety of home loan items, a home mortgage broker has accessibility to a diverse network of lenders, consisting of local financial institutions, credit rating unions, and national organizations. This broad accessibility allows brokers to provide a range of financing choices customized to the unique financial circumstances and preferences of their customers.

By check my source evaluating multiple lenders at the same time, homebuyers can gain from competitive rate of interest rates and varied lending terms (Mortgage Broker Glendale CA). This not only raises the likelihood of protecting a home loan that fits their budget plan but also gives the possibility to contrast different products, ensuring educated decision-making. Additionally, a mortgage broker can recognize particular niche loan providers who may provide specialized programs for new purchasers, such as lower deposit alternatives or gives

Furthermore, having accessibility to several lenders improves negotiation power. Brokers can leverage deals and terms from one lender versus another, possibly bring about much better funding plans. This degree of access ultimately encourages novice buyers, supplying them with the tools required to browse the complexities of the home loan market with confidence.

Time and Expense Effectiveness

Dealing with a home loan broker not just offers accessibility to numerous useful source loan providers but likewise dramatically improves time and price efficiency for newbie homebuyers (Mortgage Broker Glendale CA). Browsing the complex landscape of mortgage choices can be daunting; nevertheless, brokers simplify this process by leveraging their sector know-how and established connections with lending institutions. This allows them to rapidly identify appropriate financing products tailored to the purchaser's economic situation and goals

In addition, home mortgage brokers save clients important time by taking care of the tedious paperwork and communication included in the home loan application procedure. They guarantee that all paperwork is accurate and complete prior to submission, minimizing the chance of hold-ups caused by missing info. This positive technique accelerates approval timelines, allowing customers to safeguard funding even more quickly than if they were to navigate the procedure individually.

Conclusion

Engaging a home loan broker offers newbie buyers with crucial benefits in browsing the complicated landscape of home funding. By simplifying the home mortgage procedure and leveraging connections with several lending institutions, brokers enhance both efficiency and cost-effectiveness.

For first-time homebuyers, browsing the intricacies of the home loan landscape can be overwhelming, which is where engaging a Source home mortgage broker proves important.Furthermore, home mortgage brokers deal with the paperwork and connect with lending institutions on part of the customer, enhancing the process and minimizing some of the tension connected with getting a mortgage. By leveraging their relationships with lending institutions, home loan brokers can typically negotiate far better rates and terms than individuals could protect on their own, making their solutions indispensable for new buyers navigating the home mortgage procedure.

Ultimately, involving a home mortgage broker makes sure that homebuyers obtain tailored support, helping to debunk the home loan procedure and lead them toward effective homeownership.

Unlike traditional financial institutions, which may supply a restricted array of home loan products, a mortgage broker has accessibility to a varied network of loan providers, consisting of regional financial institutions, credit history unions, and national establishments.

Report this page